Chase allows credit card holders to move their credit limits around by simply requesting it via a phone call or sending a secure message through your online account my preferred method.

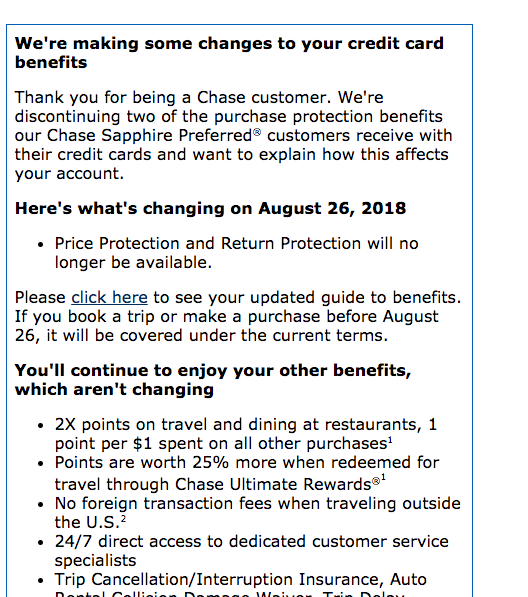

Chase sapphire maximum credit limit.

How to get approved for chase sapphire preferred.

This means that if you can t qualify for at least that amount you can t qualify for the card.

My credit score was lowered when it should.

However she says it s definitely possible to work with the chase debt lending department to increase above the maximum limit.

The lowest credit limit usually offered by chase sapphire preferred is 5 000.

The chase sapphire reserve is a visa infinite card so the minimum credit limit is 10 000.

Have an excellent credit score usually 720.

I made a 5000 payment and 2 days later i receive a notice that my new credit limit is 1250.

Chase sapphire preferred card at chase s secure website.

How to get approved for chase sapphire reserve.

There are only a few rules that need to be followed.

Specifically as a visa signature card the chase sapphire preferred card actually requires that those who are approved for the card receive a minimum credit limit of 5 000.

She says she s personally seen credit limits as high as 225k but the theoretical limit could be 500k and.

There is no hard pull credit check as long as your new credit line is below 35k.

Chase doesn t have a hard limit on the number of cards you can have at once.

So if chase doesn t qualify you for at least a 10 000 credit line then you won t be approved for the card either.

Our credit limit was 6700 with a balance of 6200.

And while the average credit limit is much lower than the six digit max cardholders can go into the process knowing they ll receive at least a 5 000 initial credit limit if approved.

I got 12 700 as my first card with chase but many people have gotten 5 6k.

Some of us on the mms team have six or more chase credit cards.

That said everyone is restricted by chase s stringent application rules including.

So if chase doesn t qualify you for at least a 5 000 credit line then you usually won t be approved for the card either.

It really depends on your credit record and income.

Instead there s a maximum amount of total credit they ll extend you.

50 dollars over the current balance.