Earn up to 120 in statement credits on qualifying doordash purchases through 12 31 2021 that s 60 in statement credits through 12 31 2020 and another 60 in statement.

Chase sapphire reserve currency exchange rate.

Credit cards mortgages commercial banking auto loans investing retirement planning checking and business banking.

Everyday banking without fees.

Earn up to 120 in doordash statement credits through 12 31 2021.

No chase foreign exchange rate adjustment fees on atm withdrawals or debit card purchases made outside the u s.

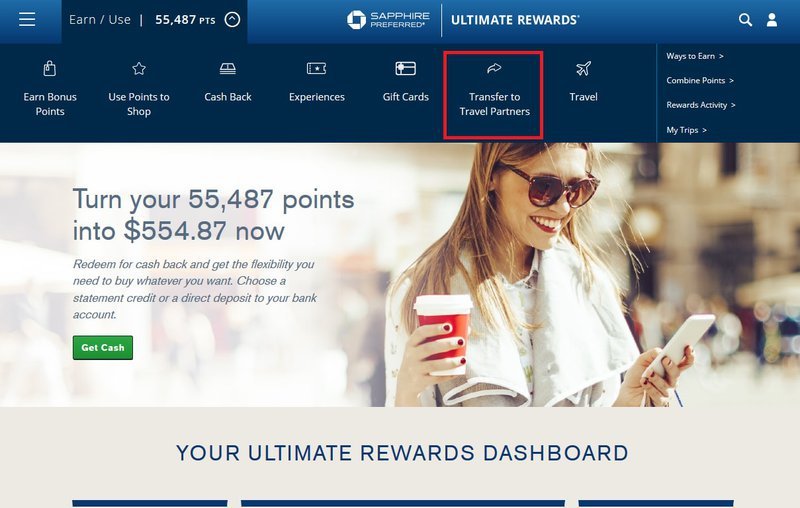

Sign up now for 100 000 points with the chase sapphire reserve.

57 84 using the chase sapphire preferred 1 1 2967 canadian dollars 57 42 using the citi prestige 1 1 3061 canadian dollars.

When you use a chase sapphire preferred or reserve credit card abroad your money will likely be converted at an exchange rate set by visa the card issuer.

Their rates are always better when you compare them with currency exchange companies such as travelex either online or at the airport.

No wire transfer fees 6 or stop payment fees.

Chase sapphire preferred card chase sapphire reserve interest rates and fees.

15 99 to 22 99 variable based on your creditworthiness and other factors.

No atm fees worldwide 1 down the street or around the globe.

Both cards earn 2x points on dining.

Chase sapphire reserve foreign transaction fees.

The visa rate tends to be a relatively good value way to spend money internationally.

Your chase sapphire reserve account must be open and not in default to maintain subscription benefits.

And you re deciding between using your chase sapphire preferred visa or citi prestige mastercard.

Chase sapphire reserve card reviews 4 641 cardmember reviews opens overlay card reviews 4 641 cardmember reviews opens overlay new cardmember offer.

Below are the rates we found as of nov.

15 99 to 22 99 variable based on your creditworthiness and other factors.

28 2018 for exchanging dollars into popular foreign currencies with the top credit card issuers along with exchange company travelex.

The problem is that this adds substantially to the currency exchange rate often between 5 10 and to the profit of both the merchant and the credit card processor sometimes without the actual consent of the customer.

16 99 to 23 99 variable based on your creditworthiness and other factors.

/chase_sapphire_reserve_FINAL-10928ca829154185a836f5ce7edd8183.png)